By Brian Lafaille, Global Head - Customer Success Strategic Programs at Google (Looker)

An excerpt (with added notes) from his post, Drive Action in Mitigating Risk

The first steps to creating a Risk Management framework are to 1. Truly understand why your customers leave, and then 2. Define the risk types and build a framework for action. Once you’ve done those two, you can operationalize the framework by 1. flagging risk, and 2. taking action.

Flagging risk

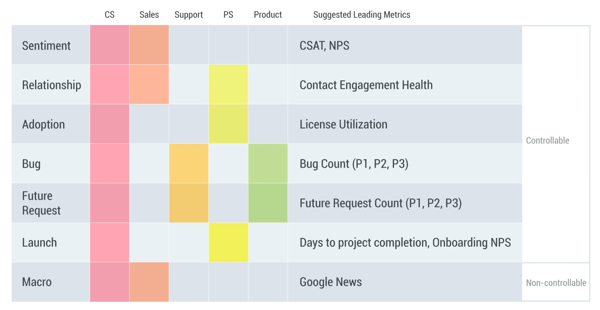

The following is an example of how you might lay out your Risk Management Framework to others in your company.

* Controllable risk are the categories that Customer Success is able to influence or impact

Now, I’d note that we created the Macro risk type prior to Covid being a major impact to our customer base. What we decided to do was have a nested taxonomy with three sub-types of risk within Macro:

- Macro → Covid

- Macro → Acquisition

- Macro → Business Viability

We have playbooks established for each of those subtypes. For instance, the actions a CS person takes for a customer being acquired is going to look different than a customer acutely impacted by Covid.

With regards to handling customers impacted by Covid asking for a commercial concession:

- If a customer is asking for a commercial concession, we've found it useful to recap the value this customer has seen throughout the partnership. That said, if it comes time to process a reduction, seek to understand the drive behind that concession ask—is it truly because the customer has some form of business viability impacting their business? Or, is it due to a lack of value realization? That'll be great insight to guide your response.

- If it's the former, process the concession with ease. Make this process simple for the customer and accommodate in whatever economic terms your financial team can stomach. Your goal here is to accommodate the request and build a fan for life.

- And if it's the latter, understand if there are ways the customer could be driving additional and expanded value from the price they're paying today. Can you "discount up" to provide additional resources that'll better establish value realization for this company, while maintaining your ARR? I'd argue that any finance team would rather give free concessions and maintain ARR, than process an ARR reduction.

Taking action

Flagging risk is only good if you’re taking action on that risk. We’ll break that down into 3 actionable steps below:

- Analytics: How are we going to track these at-risk customers?

- Playbooks: How will the field (CSMs) know the best practices for addressing this risk?

- Operations: How will we hold ourselves (CS Management) accountable to these customers in need?

- Risk Analytics

“If you can’t measure it, you can’t improve it”

Arguably one of the better quotes in business by Peter Drucker applies to our Risk Management Framework. It’s great to have the Risk Types, the Risk Arcs, the leading metrics, and the descriptions for your customer risk types so your CSMs know how to qualify risk. The next phase of maturity is building the tracking to quantifiably measure the following metrics:

- # of customers at-risk (In total + broken down by risk type)

- ARR at-risk (In total + broken down by risk type)

- % of customers at-risk

- % of ARR at-risk

- Avg. days customer is “in risk”

There are a number of platforms out there that have the ability to measure these metrics. Building dashboards to measure your at-risk customers allows your team to measure the impact they’re having after flagging a customer that’s at-risk. Focus on building your analytics strategy either within your CS Ops/Analytics team, or your central data team. This is step one in driving action and operations towards mitigating risk. Again, you can’t improve what you can’t measure.

- Risk Playbooks

The concept of playbooks stems from sports where teams run plays after noticing a behavior from their opponent. For Success, this means providing your team with a “play” when they run into a customer in one of your risk types. After building your Risk Management Framework, it’s up to you and your team to build the common play each CSM should run when approached with a customer that exhibits a certain type of risk, say, Relationship.

If your key champion leaves their role, your playbook might answer the following questions:

- What is the intended outcome of this playbook?

- What are the questions the CSM needs to ask both internally and to the customer?

- What data points must a CSM collect & analyze?

- What teams should the CSM inform / collaborate with on this risk?

- What are the actions that CSM should take?

This list above is by no means comprehensive. Every company’s playbook will be unique, but the questions above are a good starting point.

Note: Each risk type should have it’s own risk playbook, and playbooks are an ever evolving document.

- Operations

The operations surrounding risk speaks to the actions we can take to hold the company accountable to remedy customers who have veered off track in receiving value. Operations may encompass the following elements:

- Meetings:

- Consider scheduling an operational meeting (weekly/bi-weekly) that reviews the customers that are at-risk. If you have different segments, also consider grouping by those various segments. The meeting should encompass CS Leadership with a defined agenda that highlights the key customers at-risk, the actions being taken, the asks of any leaders or other departments, and next steps.

- Readouts / Newsletters:

- Evangelizing the wins of CS is a key component of the Risk Management Framework. Consider adding a section to your weekly newsletter, internal site, slack post, or your comms tool of choice that highlights the recent wins of customers who have moved out of risk, and puts the metrics front and center to the rest of the company as to how the business is doing in driving risk mitigation across the customer base. This should be shared as broadly and widely as possible. Risk Mitigation is a company-wide sport.

- Office Hours:

- Sometimes CSMs need more collaborative brainstorming with leadership to identify next steps with a particularly tricky customer account. Establishing office hours for CSMs to drop-in and get some collaborative brainstorming done can make a tremendous impact on those tricky customer scenarios.

For more on this topic, read the full Risk Management series here.

The top articles this week:

This week's newsletter features posts on:

- Deliver on the Trusted Partner Promise

- Executive Communication

- How to Manage Customers by Value

- Should CSMs get Compensated by "Uncontrollable Churn"?

TEAM BUILDING

"Deliver on the Trusted Partner Promise" and Other Advice for Founding a Customer Success Team

David Ginsburg draws from his experiences at companies like Box, Mixpanel, UserTesting, and now WorkBoard to share the four foundational elements of an effective Customer Success team.

COMMUNICATION

Executive Communication

A powerful talk by Michael Dearing on how to communicate clearly as a leader. If you’re short on time, check out the section on Minto’s Pyramid Principle.

SEGMENTATION

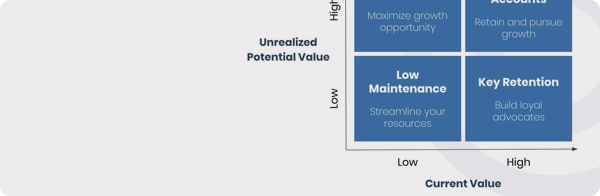

How Do You Manage Customers by Value?

Here’s a LinkedIn post from Gain, Grow, Retain where they offer a framework for segmenting the customer experience to maximize value.

RESEARCH

Should CSMs Get Compensated by "Uncontrollable Churn"?

Or Guz, Director of Customer Success at PerimeterX, opens an interesting discussion on whether CSMs should get compensated on “uncontrollable churn”. I enjoyed reading through the comments to hear different perspectives.

Submit a comment