How to Streamline Your Customer Success Workflow for Better Retention

Every CSM has a different customer success workflow. Their tasks, information, and communication all live in different places; they have email, chat, calendars, ticketing systems, call notes, and Customer Success platforms to pay attention to.

With too much noise and so many to-do’s, it’s easy for the CSM to lose track of how their customers are really doing.

It’s not for a lack of trying. Every CSM I know goes to work and does their best to ensure that accounts are healthy, and to drive growth for the business. But when CSMs are only given intelligence that comprises high-level, lagging indicators it’s nearly impossible to take specific actions to give their customer a better experience. They’re not getting the right information, but they are getting a lot of noise.

What happens when a CSM is overloaded with noise? In short, it’s more difficult for them to prioritize their time wisely. Instead of letting a key customer that has a renewal within 90 days know that the feature they requested has been shipped, they spend time responding to emails from smaller customers who don’t have a renewal coming up. Or, they get blindsided by a champion leaving an account.

There are four areas where CSMs don’t have the insight they need. In this post, I’ll walk through their current toolset, and explain how they can bridge the information gap so they can prioritize their time strategically and give customers the experience they deserve.

The Current Toolset and Customer Journey Mapping Gaps

Today, CSMs have a few ways of understanding how their customers are doing. They have:

- Task lists. CSMs have task manager tools or project management solutions that help them organize and complete necessary to-do list items for each customer. They get information about the health of their customers by moving through their list: responding to emails and reaching out to customers to schedule onboarding or check-in calls.

- Product usage metrics. There’s a whole gamut of Customer Success platforms that have built massive products around heavy, in-depth, and customizable product usage data.

- NPS data. CSMs can also get feedback about how their customers are feeling by sending NPS surveys.

Each of these channels—meetings, product usage data, and NPS data—give CSMs a glimpse of customer health. But this toolset doesn't give CSMs a full picture of the customer's experience for two reasons; 1) They don't surface the underlying activities that lead to the customer's success or failure with the product and 2) it's extremely difficult to master the ability of understanding what kind of product usage leads to renewal.

Customer Success Workflow Breaks Down

There are four areas where CSMs can get better information about their customers’ experience: onboarding, product usage, bugs and features, and champions.

1. Onboarding

Onboarding is the first activity CSMs look at to understand a customer. Most Success groups come up with a step-by-step onboarding process, where CSMs move through the tasks—do kickoff call, create CS plan, deliver training, send learning materials—checking each one off as they go.

The mindset in most organizations is that once a CSM has completed those tasks, they’re “done” with onboarding. That’s an issue; finishing a task list is not synonymous with onboarding being complete.

The only thing that matters is whether the customer thinks onboarding is finished. Do they think they're prepared to use your product?

To answer that, CSMs need to ask their champions about the following:

- Technical implementation: How have you integrated the product with your company's software and systems?

- Process integration: Have you integrated the product to your company’s workflows and processes?

By asking these questions, CSMs let each customer tell them whether onboarding is complete, and if not, CSMs can tailor their efforts to address a specific customer’s needs. Knowing that a customer isn’t done with onboarding gives the CSM a chance to go off-script to actually onboard the customer and boost customer retention.

2. Product usage

There are a handful of Customer Success tools that have dedicated huge efforts to providing extensive product usage metrics. These dashboards work for the C-Suite because they need higher-level findings given different combinations of products and usage metrics. But for the CSM, it's way too much information.

Out of the wide scope of product usage analytics found in the standard Customer Success platform, CSMs really only need two categories of information to understand how the customer is using the product:

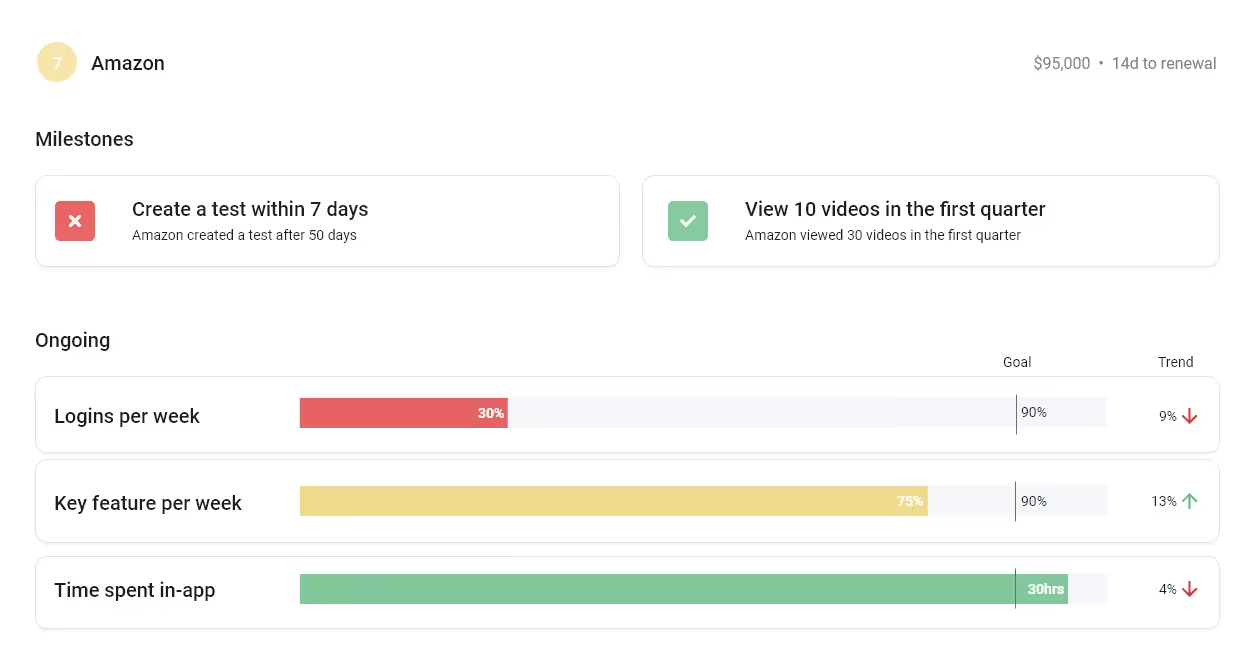

1. Milestones

Some mature companies will identify an onboarding behavior that indicates a much higher likelihood of being a long-term customer. For example, a company that offers an analytics dashboard might realize that customers are more likely to renew when they regularly use a specific set of reports.

When a CSM can quickly see whether an account missed a key milestone, they can then probe deeper into the "why" and tailor the content and engagement plans to fit that specific customer’s needs.

2. Product usage over time

Product usage is ultimately about the people and behaviors behind the numbers. Being able to see exactly who is missing the product triggers can help CSMs tailor their efforts to drive adoption with specific groups of people.

Here’s an example of a product usage report for CSMs. With just the 1.) milestones and 2.) ongoing product usage data, CSMs can get all the information they need at a glance.

3. Bugs and features

CSMs almost always promise and commit to their customers that they're going to serve as internal advocates for them within the business. The way that typically plays out is “I'm going to make sure that your bug reports get fixed and that your feature requests get included in the product roadmap.” CSMs commit to that and almost across the board, they fail to deliver.

It's not the CSMs fault. There are just so many roadblocks from a process and tooling standpoint between Customer Success and ultimately product and engineering to be able to actually deliver on that promise to the customer.

The roadblocks:

- The nuisance of creating tickets. It’s outside of a CSMs workflow and it’s not where CSMs live. They will forget or they won’t want to go over to JIRA or Zendesk. Already, CSMs lose out on some ability to create and deliver on their promise to customers.

- The impossibility of tracking the status of a ticket. Once you’ve made a ticket as a CSM, it enters the black box and you have no idea if the problem is being addressed. Here’s how CSMs look up a ticket today: log into JIRA, somehow remember (from a month ago) the name of the ticket, type in a semblance of an idea of what it could be into a search bar, gaze through a list of 20 tickets that have those keywords, guess as to which one is the correct one, and finally see the status for one ticket. Now imagine going through just five tickets. You wouldn't do it because it's the worst experience. You've wasted a half-hour trying to find five tickets. Above all, you can't efficiently track the status of a ticket and communicate that to the customer.

- Clueless as to when a ticket has been delivered. CSMs have no way to know when it's done. Many organizations use release notes to share when tickets are complete and frankly, CSMs don't have the time to go through the list of 50 updates to identify whether any are relevant to one of their customers.

This is an especially difficult problem to untangle, which is why we’ve spent so much time thinking about the right way to solve it at Nuffsaid. The short story is this:

- CSMs need to be able to create tickets in the same place where they’re communicating with customers.

- They need to be able to easily track their tickets to see how Product is prioritizing them.

- And they need to get alerts when things are shipped that are relevant to their customers, so they can quickly relay that information.

4. Champions

How do CSMs know about their champion’s health today? They don't. Period.

Here’s a scenario I’ve seen play out many times in the Customer Success realm. I call it the “Cool...” conversation. A manager walks up to a CSM and prods, “Hey, how do you feel about the health of your champions for xyz company?” The CSM responds, “Yeah...they're good. We're doing great.” And then because leadership doesn’t have any real way to probe deeper, they respond casually with “Cool... cool” and they give the CSM a thumbs up.

What a lame conversation. How can we give such a broad-stroked description of our champion relationships? In the end, humans are different, and their experiences of your product and team, surely, are different. Because of this, we need to treat each of our relationships as discrete connections that require different types of attention.

How to gauge champion health

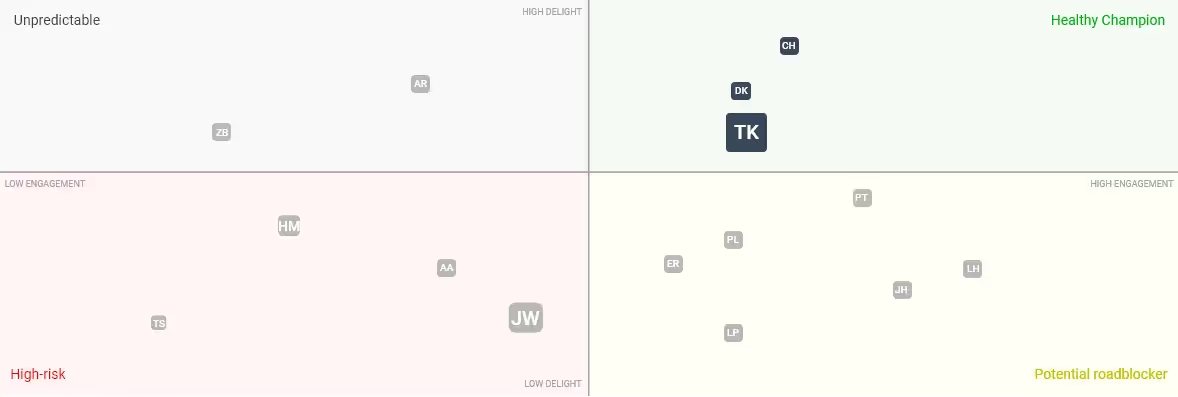

At Nuffsaid, we use a framework to help understand a person’s archetype, their relationship with the product, and the team that supports the product. For each key account, we map out where each champion is on a quadrant graph. The vectors on the graph are the engagement, delight, and influence of each individual.

- Engagement. Are they using the product? Are they answering the surveys we're sending them? Are they submitting a healthy amount of support requests? If engagement is high the champion is active with your product and with your team.

- Delight. How are they responding to those survey questions? Are we addressing their support threads quickly? Are we delivering them key features that they've requested? Is their sentiment, in terms of their engagements with you and with your team, all positive?

- Influence. We also consider the level of influence each champion has towards renewal. This is represented by the size of each individual’s “bubble”. As a CSM, I care more about the big bubbles. Is this a VP? If so, they’re deemed high influence. Are they an individual contributor in a department that doesn't usually buy your product? They have low influence. Other variables that play into category include 1.) if the customer has a skillset that enables them to promote the product and 2.) whether the customer will own the relationship in 12 months.

This framework can give CSMs direction. For example, if a high-influence individual at a key account is in the lower right quadrant of your graph, it essentially means that the person cares about the problem your product is trying to solve, but they don’t like the way you’re solving it. In a competitive landscape, this kind of individual may shop around and look at other similar tools.

Conclusion: Why a Streamlined Customer Success Workflow Is Key to Retention

CSMs are the champions of customer health. It’s a shame that they are pulled in so many directions; this leads CSMs to unintentionally put some customers on the back burner, while putting fires out elsewhere.

But when CSMs have the volume turned down, when there is an efficient customer success workflow established, and when they are given the right information to clearly see a full picture of how their customers are experiencing the product, they can do what they do best: provide their customers with a world-class experience.

Combining smarter customer journey mapping with actionable insights helps create a personalized, timely experience that directly supports customer retention.

.svg)