Champion Strategy: Build Stronger Relationships to Reduce Churn Risk

Remember the “good old days” when software came on a disk, and waiting for dial-up was exciting?

Ah, simpler times.

Back then, post-sale activities were managed by Account Management, “renewals” were new versions of the software, and buying roles were much simpler and easier to understand:

- VPs had the power to buy products,

- Directors had influence in the buying decision, and

- Individual contributors were the end users and didn’t have an important role.

But as software transitioned to the cloud and as product-led growth became en vogue, these definitions fell short. They failed to capture new factors in buying processes like levels of authority, influence in decision making, and product usage.

What emerged were 3 new roles:

- Buyers

- Champions

- Power Users

These new names captured factors in modern buying processes, but for those of us that didn’t grow our careers through Account Management, they made it harder to understand what each role means.

This piece is written to re-capture some of the simplicity of earlier models, and to provide a framework for determining the right amount of relationship coverage for each segment in your business. If you’re focused on champion strategy and long-term retention, here are three things you can do today to start building stronger relationships with customers.

Part 1: Define Champion, Power User, and Buyer

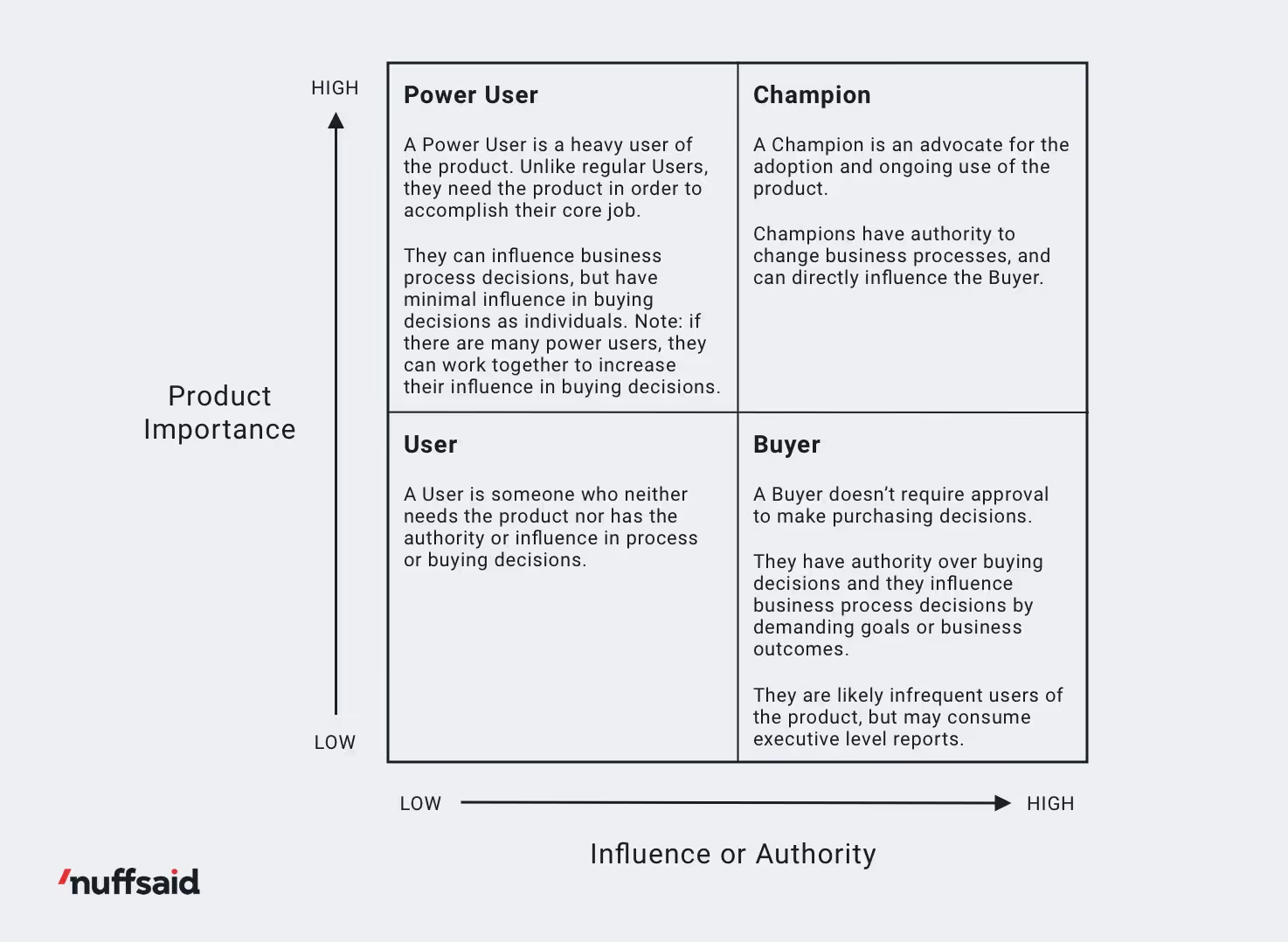

To get a better understanding of what these terms mean, it’s helpful to compare them to each other. The graphic below helps visualize how the Champion, Buyer, and Power User roles are different by looking at their Influence or Authority, and their Product Importance.

Influence defined (x-axis)

Influence is the weight of a person’s opinion in the mind of the decision maker. Influence often comes from a small number of high ranking people, or a large number of low ranking people.

Authority defined

Authority is the power to make final decisions without approval from someone else.

Product Importance defined (y-axis)

This measures how critical the product is to accomplish the user’s job. If the product is of low importance, the user can replace or work around the product. If the product is of high importance, the user requires the product to perform their core job.

This quadrant does not include...:

We don’t use common attributes like Advocacy, Budget, and Volume of Usage as factors for this quadrant because they don’t help determine the difference between user types.

- Advocacy is a measurement of endorsement, so it could apply to any user type. It doesn’t help differentiate a Power User from a Champion, for example.

- Only the Buyer has budget, so it’s irrelevant for other user types.

- Any role could have a high or low volume of usage, so it doesn’t help differentiate the user types.

Part 2: Track the strength of the relationship

Next we must determine which contacts are most engaged with us and focus on those relationships. For example, Champions who respond to emails regularly, ask questions, and make feature requests are more engaged (and valuable!) than Champions who frequently ghost you.

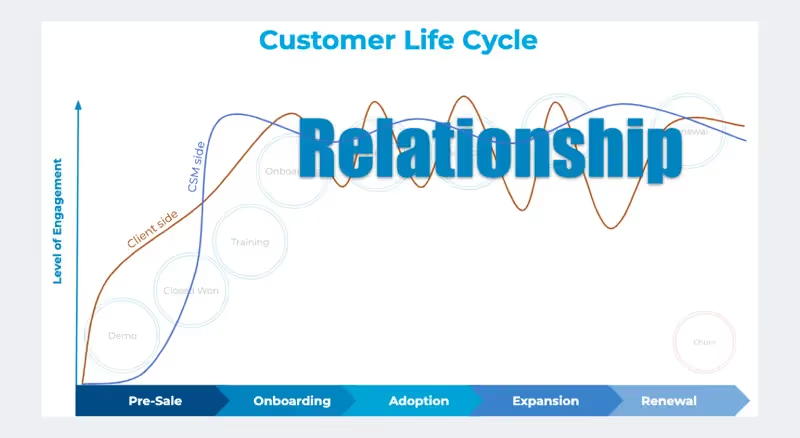

Many Success teams start by visualizing their engagement model in a single slide, and defining when they expect CSM and Customer engagement to increase or decrease.

Shout out to Ziv Peled for the graphic and inspiration on this topic.

The highest performing Success teams then develop a scoring model to determine which relationships are the most influential. One of the best ways to score relationship strength comes from Jay Nathan and Jeff Breunsbach of Customer Imperative. Here’s the scorecard they use:

Now that we’ve defined 1) relationship roles and 2) relationship depth, we can move onto the final step of determining how many of each relationship we need to reduce churn risk.

A performance scorecard like this gives visibility into which relationships are thriving and which ones need nurturing, essential for an actionable champion strategy.

Part 3: Reduce churn risk with the right relationship coverage

When we spoke to companies about their champion coverage strategy, we heard consistent problem trends:

- The influence that Power Users have on Champions is undervalued

- The number of Champions required is insufficient to reduce risk

- The named Champion in the sales cycle isn’t acting like a Champion post-sale

- Unclear definitions of user types (Influencers, Important Contacts, Advocates, etc) leads to poor/incomplete tracking

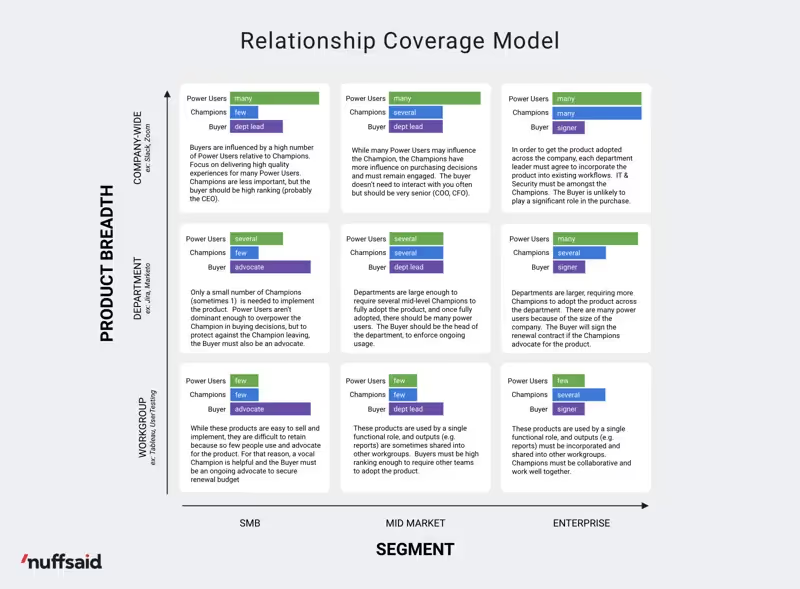

Here, we’ll review a model for relationship coverage that addresses these problems and will enable any company to adopt a coverage plan that will significantly reduce churn risk. Here’s how to read the model below:

- Product Breadth is shown vertically—it divides products into 3 categories based on who the primary users will be: a workgroup, the whole department, or the entire company

- Segment is shown horizontally—it divides target buyers into company size (SMB, Mid Market, and Enterprise)

Then in each of the 9 cross-sections, we show how many buyers, champions, and power users you need to reduce customer churn risk. As you'll see, buyers are further broken out into three types:

- An Advocate buyer is someone who endorses the product. This is the most valuable kind of buyer.

- If you can’t get an Advocate buyer, get the head of the department you’re selling to (in the graph, we call this the Department Leader buyer).

- A Check-signer is a buyer who isn’t in the department you’re selling to, but they’re in a budget approval role (e.g., CFO, COO, Procurement).

If a company-wide product (Slack, Gmail, Zoom, Box) is trying to sell into SMBs, they’ll likely focus on a large number of influential Power Users to reduce churn risk. But if a Workgroup product (Tableau, UserTesting, Qualtrics, Google Analytics) is trying to sell into the Enterprise, they’ll instead develop strong champions in other departments who are consumers of the Workgroup’s output.

Summary: Champion Strategy Framework for Stronger Customer Relationships

A well-defined champion strategy empowers Customer Success teams to build deeper relationships, reduce churn risk, and create scalable, repeatable success across accounts. By aligning with key stakeholders like buyers, champions, and power users, you set the foundation for long-term retention and growth.

Here’s a step-by-step summary to put your strategy improvement plan into action:

- Define key relationship roles

- A Champion is someone who actively advocates for your product, has influence in the purchasing process, and holds authority over internal decisions.

- A Power User is a frequent product user who relies on it to do their job well but may not hold purchase authority.

- A Buyer has the final say in purchasing decisions and controls budget allocation.

- A Champion is someone who actively advocates for your product, has influence in the purchasing process, and holds authority over internal decisions.

- Track relationship depth with a performance scorecard:

Use a structured performance scorecard to evaluate relationship strength—track engagement levels, responsiveness, feature requests, and more. This allows you to prioritize accounts with strong advocates and uncover hidden risk. - Ensure the right coverage across account roles:

Every account should have a balanced mix of Buyers, Champions, and Power Users depending on the size of the company and how widely your product is used. Your champion strategy should adapt based on whether you're targeting a workgroup, department, or enterprise-level deployment. - Improve outcomes with strategic alignment:

Effective strategy improvement involves mapping relationships, monitoring role engagement, and refining your coverage model based on data and outcomes. This turns relationship insights into tangible business results.

By combining a clear champion strategy, a robust performance scorecard, and continuous strategy improvement, your team can strengthen customer relationships and protect revenue across all segments.

Thanks to Ziv Peled, Kristina Valkanoff, Jeff Breunsbach, Jay Nathan, Emilia D'Anzica, Kristi Faltorusso, and David Ginsburg for your feedback and contributions to this piece.

.svg)